If you do get stuck, QuickBooks Online help is easily accessible from within the application, or you can check out the various QuickBooks Online training options offered by Intuit. In order to make your invoices stand out to your customers and get paid quicker, be sure to set up your invoice preferences prior to sending out your first invoice. As a small business owner, it’s likely that invoicing will be the most important feature you’ll use in QuickBooks Online. You can repeat these three steps for each account you wish to connect. Connecting your bank or financial institution also ensures that your account balances are current and reports are accurate.

Add more users

You can import information such as your bank transactions, your Chart of Accounts, supplier bills, employees, budgets and customer or vendor data. If you run a small business, you’ve likely heard of QuickBooks Online, the smart accounting software that helps you keep on top of everything from taxes to payroll. But if you’re new to QuickBooks (or perhaps you’ve switched from QuickBooks desktop version), you might be wondering just how to use it. We can also offer deals on the best payroll software solution on the market. Whichever service you use, you’ll want it integrated with your accounting software to automate your tax process.

Is QuickBooks Online difficult to learn?

- No need to worry if you skip one; you can go back and add others later.

- Once you’ve set everything up and learned how the process works, it’s just a matter of checking in on a daily or weekly basis to make sure it’s all running smoothly.

- Want to add more users to your account so you don’t have to do it all yourself?

- Perhaps you’ve just received your electric bill, but it’s not due until the end of the month.

- Learn about the different ways you can record your spending, how to record and categorize your spending and the difference between bills, bill payments, expenses, and checks in QuickBooks.

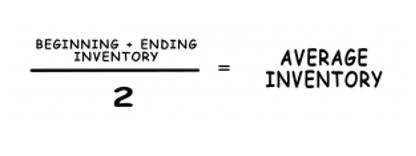

Learn about how to add a new supplier to save time, edit supplier information and add columns and sort the how to calculate fcff and fcfe Supplier List to get more insight. As a new user, the first thing you’ll have to do is set up QuickBooks Online for your business. However you work, no matter what your business does, QuickBooks has a plan for you. Watch step-by-step tutorials to learn all the QuickBooks tips and tricks. Learn about what the Chart of Accounts is and how it is used on transactions along with different parts of the Chart of Accounts.

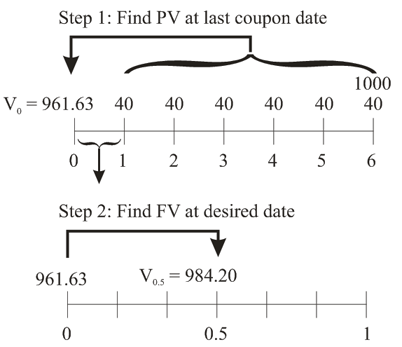

Why Do Small Businesses Use Float?

Learn about the different ways you can record your spending, how to record and categorize your spending and what is a book steadiness and an obtainable balance the difference between bills, bill payments, expenses, and checks in QuickBooks. Learn how to send reminders to customers when invoices are overdue, and also how to set up batch actions to send multiple invoice reminders in QuickBooks. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market.

QuickBooks Online stands as the best accounting software that our researchers have tested, due to a great feature catalog, reporting tools, a top-quality support team, and a customizable interface. When the bill becomes due, you can choose from a variety of payment options available in QuickBooks Online, including an option to pay electronically directly from the application. However, as a new user, you may be feeling a little overwhelmed right now. Even though QuickBooks Online is user friendly, it might help to get a little more acquainted with some of its bookkeeping features, which include double-entry accounting. Once you’ve selected the relevant transactions, QuickBooks will download them automatically.

With QuickBooks Online you can access your accounts anywhere, at any time. But it also connects with thousands of compatible apps, available in the QuickBooks App Store, guaranteed to make your life easier, with 86% of QuickBooks customers agreeing that apps save them time. From expense management to QuickBooks cash flow forecasting, you can choose a selection of apps that will streamline your processes and make it easier to stay on top of your business finances. Whilst you’re updating your company information, you can also tweak your financial preferences in this part of your QuickBooks Online account from the sales, expenses and advanced tabs.

Hello! Welcome to QuickBooks Support.

You can browse the different categories in the app store, or if you know what you’re looking for, simply search for the app’s name. The how to calculate the effective interest rate Float app is QuickBooks’ most popular operational cash flow forecasting add-on, so if you’re looking to understand what your future bank balance looks like, join the thousands of users already using Float to save hours every week. It’s quick and easy to automatically import your business data to your QuickBooks Online app, so you don’t have to start from scratch.

You can sync your QuickBooks Online account with your bank accounts and credit cards at this stage. This means that QuickBooks will automatically download and categorize your previous transactions from your accounts, saving you time and effort as you won’t have to enter any details manually. Along with producing quality invoices for your customers, you’ll also want to properly manage your expenses, whether it’s to create an expense report or to simply better track your business expenses. Perhaps you’ve just received your electric bill, but it’s not due until the end of the month. If you want to enter the bill to be paid when it’s due, you’ll want to use QuickBooks Online’s accounts payable feature, which you can access by clicking on the Bill feature in the application. QuickBooks Online gives you the option to connect your bank accounts directly to the software.